HONG KONG — Chinese electric vehicle (EV) battery giant Contemporary Amperex Technology Co. Limited (CATL) saw its shares climb as much as 18% during its first day of trading on the Hong Kong Stock Exchange, following the largest initial public offering (IPO) globally in 2025.

The company raised approximately HK$35.7 billion (US$4.55 billion, £3.4 billion), marking a significant boost for Hong Kong’s capital markets amidst geopolitical tensions and trade uncertainties.

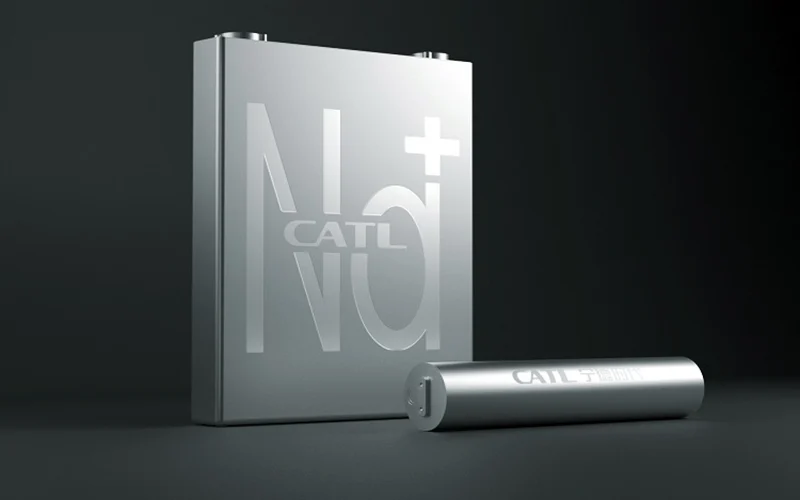

CATL, already listed on the Shenzhen Stock Exchange with a market valuation exceeding 1 trillion yuan (US$138.7 billion), dominates the global EV battery market—accounting for over one-third of all batteries sold worldwide. It supplies major automakers including Tesla, Volkswagen, Toyota, and Stellantis.

IPO Seen as Key Moment for Hong Kong Markets

Industry analysts say the successful debut signals continued investor confidence in the EV sector and underlines Hong Kong’s role as a critical financial hub.

“The performance of the stock was very good in what is going to be a key IPO for Hong Kong given the size of the listing,” said Neil Beveridge, Head of Asia Research at Bernstein.

Despite escalating tensions between the US and China, CATL’s limited exposure to the US market appears to cushion it from the full impact of American tariffs. According to Beveridge, “The direct implications of what we are seeing with tariffs will only have a limited effect on the company.”

Global Expansion and Innovation Drive Growth

Founded in 2011 in the city of Ningde, CATL has grown rapidly alongside China’s booming EV market. The company employs over 100,000 people globally and operates 13 production facilities, including recent and upcoming plants in Germany, Hungary, and Spain.

In December, CATL announced a $4.3 billion joint venture with Stellantis to build a major EV battery plant in Spain, which is expected to become operational by late 2026.

CATL also invests heavily in research and development, operating six R&D centers globally. Last month, it unveiled a breakthrough battery technology capable of delivering 323 miles (520 km) of driving range after just five minutes of charging—a milestone in EV performance.

“The innovations that we’re seeing from CATL are unbelievable, particularly in the fast charging area,” said Tim Buckley, founder of the Australian think tank Climate Energy Finance.

US Scrutiny Continues Over Military Links

Despite its technological advancements, CATL has drawn political scrutiny in the US. In January, the US Department of Defense added CATL to a list of firms allegedly linked to China’s military. CATL has strongly denied the allegations, calling the move a “mistake.”

Further concerns were raised in April when US lawmakers urged major banks such as JPMorgan and Bank of America to withdraw from participating in CATL’s Hong Kong IPO.

However, analysts like Buckley argue that cooperation—not isolation—should define future clean energy partnerships.

“The US should be looking to work with Beijing on the advancement of renewable energy,” Buckley said.

A Global EV Powerhouse

CATL’s strong debut in Hong Kong and continued technological momentum highlight its dominant role in the EV battery industry. As the world’s top battery supplier and a leader in innovation, CATL remains a cornerstone in the global shift toward sustainable transportation—even as geopolitical headwinds persist.

For more EV industry news, innovations, and clean energy insights, visit BlogHear.com—your trusted source for global technology trends.