If you’re new to investing and curious about how to invest in share market in Sri Lanka 2025, you’ve come to the right place. The Colombo Stock Exchange (CSE) is gaining attention as more Sri Lankans look for ways to grow their wealth beyond traditional savings. Whether you want to invest a small amount or build a substantial portfolio, understanding the process of investing in shares is crucial in 2025.

Learning how to invest in share market in Sri Lanka 2025 means more than just buying stocks—it involves opening a CDS account, selecting a reliable broker, researching companies, and making smart investment decisions suited to your financial goals. With technology making stock trading easier and more accessible than ever before, anyone can start investing in the Sri Lankan share market with confidence.

In this guide, we will walk you through every essential step so you can start investing wisely. From understanding key stock market terms to choosing your first shares, this article will cover everything you need to know about how to invest in share market in Sri Lanka 2025. Whether you’re looking to create passive income, save for the future, or simply grow your money, this guide is designed to help you take that first important step safely and successfully.

Why You Should Invest in the Sri Lankan Share Market in 2025

Before diving into the “how,” let’s understand the “why.” In 2025, Sri Lanka’s economy is showing signs of recovery and growth, with promising opportunities in sectors like banking, construction, tourism, and renewable energy. The Colombo Stock Exchange (CSE) features some of the most prominent companies in the region, many of which are undervalued and poised for growth.

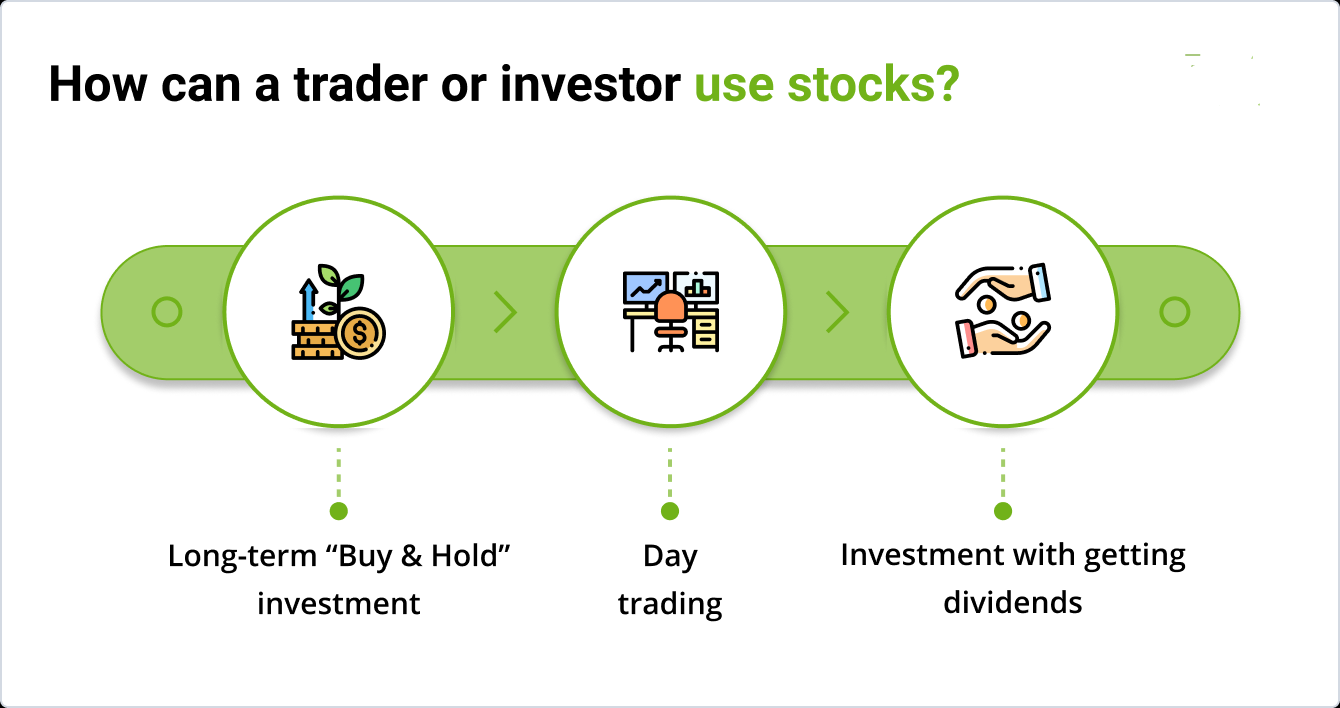

Investing in shares can:

- Build long-term wealth

- Beat inflation

- Generate passive income through dividends

- Provide ownership in top-performing companies

Understanding how to invest in share market in Sri Lanka 2025 means taking advantage of these benefits early while the market is still developing.

Step-by-Step Guide: How to Invest in Share Market in Sri Lanka 2025

Let’s break down how to invest in share market in Sri Lanka 2025 into clear, actionable steps.

1. Open a CDS (Central Depository System) Account

You can’t invest in Sri Lanka’s stock market without a CDS account. It’s like your bank account for shares.

- Visit an approved stockbroker or a commercial bank registered with the CSE.

- Submit your NIC, proof of address, and a completed CDS application.

- Once verified, you’ll receive your CDS number, allowing you to begin trading.

This is the first and most essential step in learning how to invest in share market in Sri Lanka 2025.

2. Choose a Stockbroker or Online Trading Platform

Selecting the right broker is crucial. Some of the most popular brokers and platforms in Sri Lanka include:

- First Capital Equities

- Asia Securities

- SC Securities

- Capital Alliance (CAL)

- Bartleet Religare

Look for brokers that offer:

- Online and mobile trading

- Real-time market updates

- Low transaction fees

- Research reports and investment guidance

In 2025, many brokers have apps that make investing in the share market easier than ever.

3. Learn Basic Stock Market Terms

If you’re serious about how to invest in share market in Sri Lanka 2025, take time to understand basic investing terms:

- Shares/Stocks: Units of ownership in a company.

- IPO: Initial Public Offering—when a company goes public.

- Dividends: Profit-sharing payments made to shareholders.

- Bull Market: A market that is rising.

- Bear Market: A market that is declining.

Understanding these terms helps you make smarter investment decisions.

4. Research Companies Before Investing

This is one of the most important steps in how to invest in share market in Sri Lanka 2025. Don’t just buy shares because someone recommends them—do your own research.

Check:

- Financial statements

- Dividend history

- Sector performance

- Market trends

- Company news and management

Use tools like the CSE website or the broker’s app for up-to-date market data.

5. Start Small and Diversify

You don’t need a lot of money to start. Many investors in Sri Lanka begin with Rs. 5,000–10,000. Choose a few companies from different sectors to reduce risk. For example, invest in one bank, one manufacturing company, and one utility company.

Diversification is key when learning how to invest in share market in Sri Lanka 2025 to avoid putting all your money in one stock.

6. Monitor Your Investments and Be Patient

Check your portfolio regularly but don’t panic with every small change. The stock market fluctuates. Stay updated with news that could impact your investments and adjust your portfolio as needed.

Long-term patience often leads to better returns, especially in emerging markets like Sri Lanka’s.

Tax and Legal Considerations

There is currently no capital gains tax on listed shares in Sri Lanka, which is a major advantage. However, dividend income is subject to withholding tax at the source. Always stay informed of any tax law changes that may impact your investments.

If you’re a non-resident or foreign investor, there are additional requirements through the Foreign Investment Facilitation Board.

Tips for Safe Investing in 2025

- Avoid stock tips from unverified sources or social media hype.

- Never invest money you can’t afford to lose.

- Use reputable brokers only.

- Keep track of market news via reliable sources like the CSE website, NewsFirst.lk, or DailyFT.

Final Thoughts: How to Invest in Share Market in Sri Lanka 2025

Investing in the Colombo Stock Exchange is an excellent way to build wealth and participate in Sri Lanka’s economic growth. By understanding how to invest in share market in Sri Lanka 2025, you’re positioning yourself for long-term financial success. From opening your CDS account to selecting a trustworthy broker, researching companies carefully, and diversifying your portfolio, every step plays a vital role in your investment journey.

Remember that the stock market requires patience and continuous learning. While market fluctuations are inevitable, staying informed and making well-thought-out decisions will help you maximize returns and reduce risks. The lack of capital gains tax on listed shares in Sri Lanka makes investing even more attractive, but always keep abreast of any legal or tax changes.

As Sri Lanka’s market matures in 2025, new opportunities will emerge across sectors like banking, tourism, and renewable energy. By starting now and following the key strategies outlined in this guide on how to invest in share market in Sri Lanka 2025, you’ll be well-prepared to seize these opportunities.

Take that first step today. Open your CDS account, choose a broker, and start exploring the market. Your journey to smart investing and financial freedom begins here.

For more investment tips, market updates, and beginner-friendly guides, visit BlogHear.com—your trusted partner in navigating Sri Lanka’s share market and beyond.

How To Buy NVidia Stock in 2025? A Comprehensive Guide for Investors